Market Overview

Markets got a little bit more interesting here in the fourth quarter. The S&P 500 had a nice run into and out of the election, and then saw choppy waters coming off of an early December high. International stocks fared worse, with a trickle down for nearly the entire quarter. Bonds also fell slightly as long term interest rates ticked modestly higher, despite another cut of short term rates by the Federal Reserve Board.

Over the whole year, it’s hard to find much to complain about. US Stocks are up in a big way. International is flat to positive, bonds are down modestly. Diversified investors are probably seeing 1-year returns roughly in line with, or ahead of, (reasonable!) long term expectations. Over longer periods of time, we’ve been through a lot in 5 years. The pandemic “crash” looks like a little wiggle on a 5-year chart now. Bonds had a rough few years as inflation and long term interest rates jumped. Stocks were up a lot, down some, then up a lot again. I always find it useful to zoom out, to look back, and consider how certain things seemed so big and scary in the moment. Eventually the intensity of those moments fades as we refocus on whatever is in front of us in the present. A good reminder for the next moment of intensity, whenever it decides to arrive.

| 4Q 2024 | 1 Year | 3 Year | 5 Year | |

| Large Cap US Stocks | 2.41% | 25.02% | 8.94% | 14.53% |

| Small Cap US Stocks | -0.58% | 8.70% | 1.91% | 8.36% |

| International Equity | -8.11% | 3.82% | 1.65% | 4.73% |

| EM Equity | -8.01% | 7.50% | -1.92% | 1.70% |

| Aggregate Bonds | -2.61% | 1.82% | -1.79% | 0.06% |

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future of results. S&P 500, S&P 600, MSCI EAFE Index, MSCI EM Index, S&P US Agg Bond Index. Returns as of 12/31/24.

Economic Update

As has been the case for several quarters now, the broad US economy continues to chug along in a steady, if unexciting, manner. In the fourth quarter the Federal Reserve continued to lower short-term lending rates, with a 0.25% drop at the December meeting.

The Fed continues its balancing act to manage inflation and economic growth. As inflation remains tame, the Fed was sufficiently comfortable lowering rates modestly. Off the post-Covid spike, inflation has been low and steady, now at 2.7%.

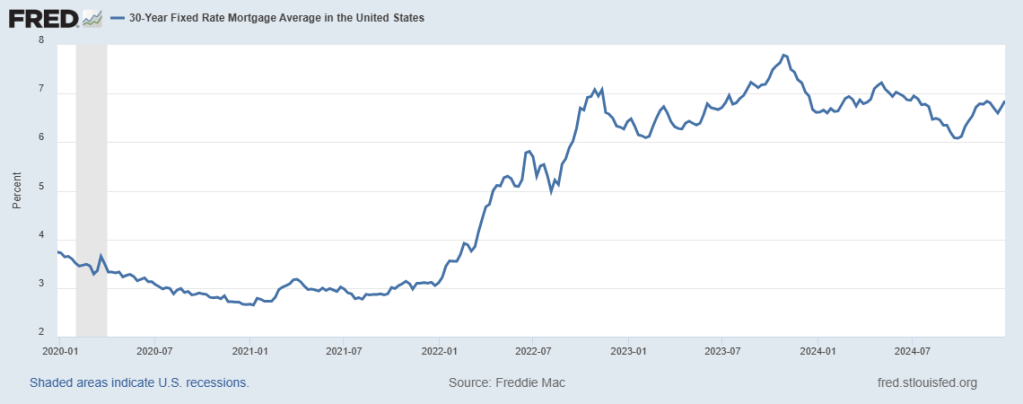

With that said, long term interest rates have not responded as quickly to either the Fed’s short term rate cuts or cooling inflation. Mortgage rates remain stubbornly high, again approaching 7% and coming off of recent lows.

Housing remains steady as national home prices made modest gains in the face of rising inventories and relatively high mortgage rates, up 3.6% year over year in October.

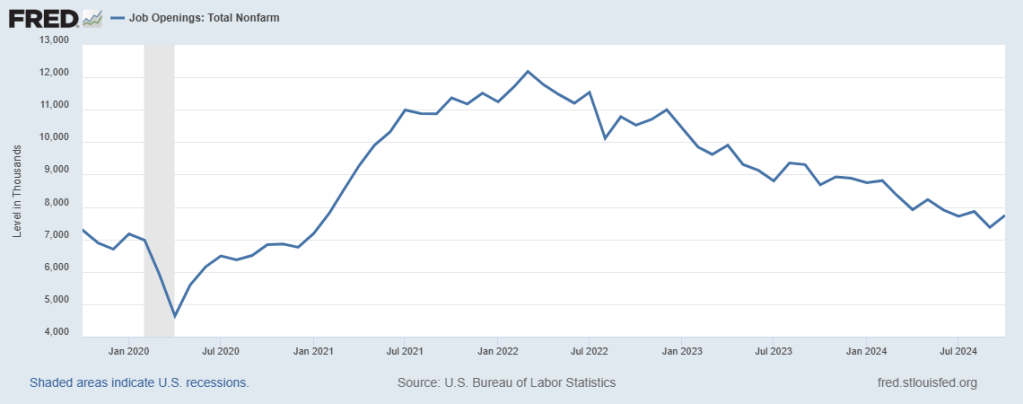

The labor market is also steady, with new job openings positive but still on the downward trend as this economic cycle ages.

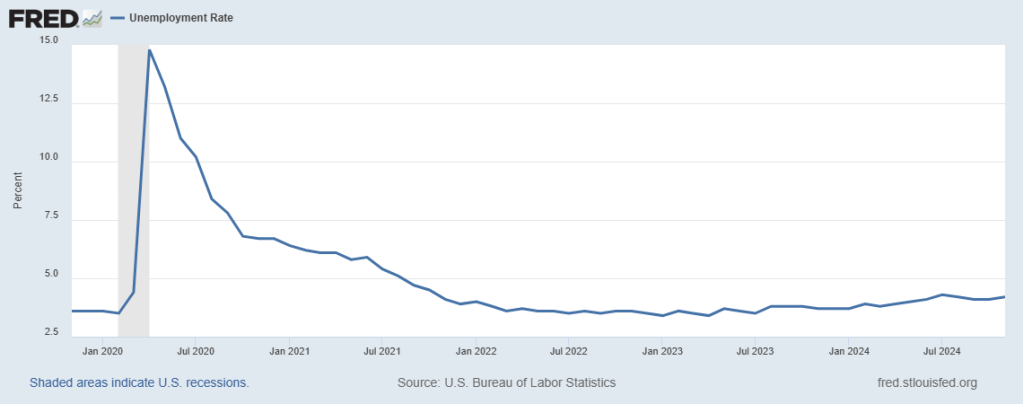

The unemployment rate remains low by any historical measure, most recently at 4.2% in November 2024.

Real Gross Domestic Product is still positive. The most recent reading of 3Q year over year change at 2.7% was above FOMC expectations.