It’s clear that 2020 will be a year for the history books. In February we were setting record market highs and economic activity continued its long, slow and steady growth out of the financial crisis over a decade removed. And then of course we were smacked in the face by one of the steepest declines in market prices and economic activity on record. Add in a healthy dose of social unrest, protests and demonstrations and we’ve had a decade of history in six months.

All I can think of lately is just how unsettled everything feels in the world today. How long will we be dealing with public health consequences of the coronavirus? How bad will the near and long-term impacts be of the shutdown, social distancing and restricted movement be on the economy? How long will the retail and service industries suffer? When can twenty million Americans go back to work? How will we come to terms with social injustices, racism and division in our nation? What is going to happen in the upcoming election cycle, and what are the consequences to all of the above?

It’s easy to look and feel very uncertain, very unsettled about the world. This thought comes with an underlying myth: that at some point, everything will suddenly feel settled and certain. The only thing that is every settled is history (and that may be a matter of perspective!). The future is never settled, never certain, never without a haze lying over it. The past feels settled to us because it is behind us. But even that settled past was in no way easy, clear or certain while we went through it. The outcome of a war, an election, a protest, a recession; these things were always scary, unsettling, uncertain and foggy in the moment. And so, today is as well. Let’s not kid ourselves that there will be some future moment when we can see ahead clearly. There’s a reason it is called “clairvoyance” and a reason that we leave it up to carnival booths and roadside attractions.

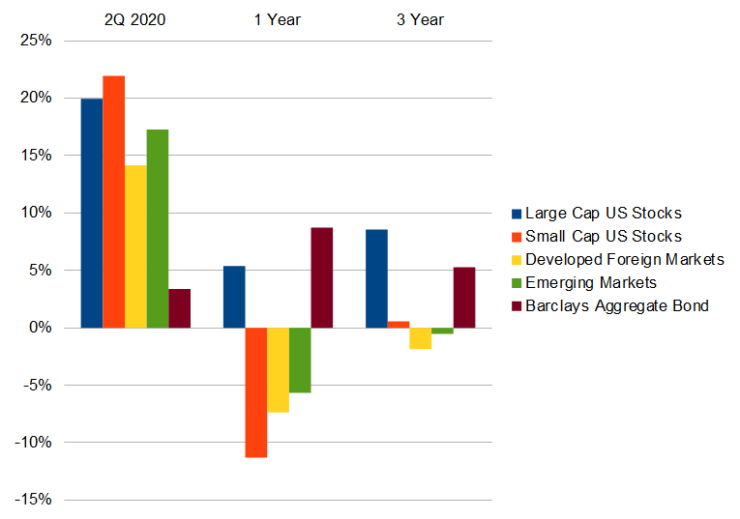

After a terrifying 6 weeks to end the first quarter, global markets bounced back aggressively in April and May once we collectively decided that the world was not coming to an end. Across US and international stocks, large and small, developed and emerging markets, stocks rallied in the second quarter. Over longer periods, most markets are behind large cap US stocks, which continue to lead returns. Bonds have also performed well, with gains of 8.74% over the last year and 5.27% over three years.

Economic Update

It is quite the understatement to say that it was a difficult economic environment in the last quarter. The broad shutdown enacted in an effort to slow to spread of the coronavirus had sharp and immediate impacts.

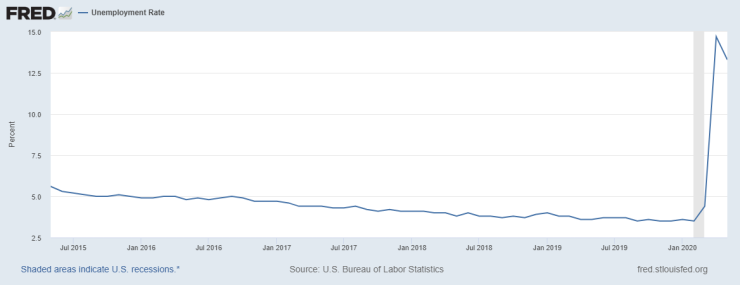

Unemployment shot through the roof in March, reaching levels so high they appear unrealistic. Initial claims hit nearly 7,000,000 and have since tapered somewhat, but still remain very high.

The unemployment rate almost touched 15% immediately after the shutdown and has come off that high just slightly as millions of Americans remain out of work. The BLS reported on June 5th that employment grew by 2.5 million and the rate fell to 13.3% in May. This rate is an increase of 9.8% of pre-coronavirus levels in February.

With the drop in employment, it is no surprise that personal income and spending have also fallen sharply. Personal income (exclusive of transfer payments including stimulus checks) has fallen back to 2017 levels, and is now showing signs of a modest recovery in May.

Personal spending follows a similar pattern with a dramatic fall as the economic shut down and a sharper recovery as retailers, restaurants and other establishments re-opened in the last few weeks.

Ripple effects of the shutdown are spreading throughout the economy as mortgage delinquencies rise and forbearance has increased in the last quarter. The number of borrowers more than 30 days late on mortgage payments reached its highest level since 2011 in May, with 4.3 million Americans now behind. These figures are likely to increases given the lagged nature of the data. It is worth noting that these delinquencies include borrowers who are taking advantage of forbearance programs agreed upon by lenders. Many borrowers are simply skipping payments because they have been allowed to do so.

Interest rates across the board have fallen and that includes mortgages. 30 year mortgage rates continue to flirt with all-time lows, with national rates falling under 3%.

After a quick decline in March and April, pending home sales have begun to recover. May showed a 44% increase in pending activity after the bottom in April, the biggest one-month change ever recorded.

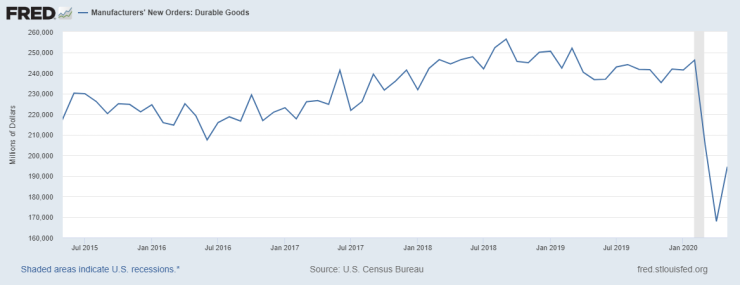

Manufacturing industries were not spared by the shutdown in March and April either. Durable goods orders fell off a cliff into the shutdown but are beginning to show a recovery as well.

In sum, most of the data reflects a consistent story: a very sharp and sudden decline in economic activity, spending and household income as the shutdown was implemented. We’re now seeing a quick turn back up in most measures, although we remain well below pre-shutdown levels of activity. Policy makers and health officials continue to try to walk the line between health consequences and economic recovery.